Hardly a week goes by where someone doesn’t remark that stock prices are too high given the unpredictable nature of our current president.

The idea that stock market investors will “surely come to their senses” and drive prices lower, makes intuitive sense. Stockholders naturally shun uncertainty, and the lack of clear policy leadership in Washington is exactly the sort of thing that might lead to investor concerns.

The flaw in this logic, however, is that we are assuming that stock market prices haven’t already factored in the doubts about the president’s ability to lead the nation forward. In my view, this assumption is a misguided and incorrect.

Financial markets are made up of millions of investors making daily buy and sell decisions based on the latest news and consensus expectations of the day. Every buyer and seller has access to the same information as you and I do. The Trump presidency, and all that it means, is known to everyone.

Market timing, which is a form of active management, is built on the idea that investors can outsmart the markets by identifying when stocks are a good or bad investment. When we base investment decisions on the view that prices are headed for a fall, we’re essentially wagering that anyone buying stocks is surely making an unwise investment. Naturally, this cannot be true because today’s stock market prices already incorporate all that’s known about our president’s strengths and weaknesses. Today's prices reflect the balancing point of the doubters and the optimists.

Making investment decisions this way also takes us off our wealth building track and decreases the chances of achieving our long-term goals. Being out of the market for even a few days can cause us to miss out on stock market rallies that might occur when we least expect them. These rallies are so critical for achieving the level of asset growth our financial plans depend on. Further, studies have shown that retail investors tend to underperform institutional investors over the long-term simply because of market timing decisions.

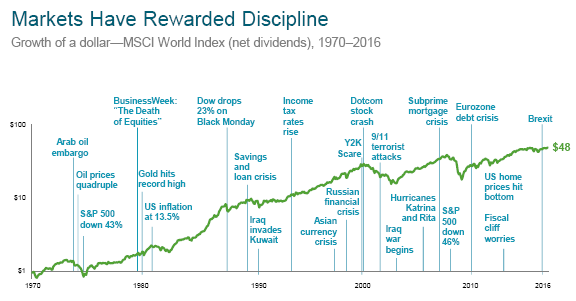

This week’s chart illustrates world stock market history from 1970 through 2016. You’ll note all the major and minor events that occurred over the past five or so decades. Each event taken alone, and known in advance, might have provided justification for being out of the markets. Yet markets have continued to recover from the bumps in the road and grow over time.

Are today’s political matters so financially consequential as to derail long-term stock market trends? My sense is that stocks will continue to be a good investment for those with longer time horizons who don’t allow emotion and intuition to interfere with sound investment decisions.

Markets Have Rewarded Discipline

______________

Disclosures